Many state Medicaid systems today are a patchwork of vendors and capabilities not designed to pull and track data from disparate sources — a capability at the core of tracking…

- Home

- >

- Blog

- >

- Page 36

Blog

Georgians for a Healthy Future hit the road again recently, this time to Savannah! Along with the Georgia Budget & Policy Institute and the Chatham County Safety Net Planning Council, we hosted Coverage and Access to Care: A Local Focus on Savannah. The event provided the opportunity to have a roundtable discussion about the health and health care needs of people in Georgia’s coastal region. We were joined by representatives from local hospitals, insurers, non-profit organizations, enrollment assisters, and interested Savannah residents for the gathering.

Georgians for a Healthy Future hit the road again recently, this time to Savannah! Along with the Georgia Budget & Policy Institute and the Chatham County Safety Net Planning Council, we hosted Coverage and Access to Care: A Local Focus on Savannah. The event provided the opportunity to have a roundtable discussion about the health and health care needs of people in Georgia’s coastal region. We were joined by representatives from local hospitals, insurers, non-profit organizations, enrollment assisters, and interested Savannah residents for the gathering.

Guided by the chart book, the group had a dynamic discussion about how we could make Georgia’s Medicaid program work better for those who are already enrolled, as well as the benefits of expanding it to cover Georgians in the coverage gap. It was clear the attendees were eager to talk about improving coverage and access to care by closing Georgia’s coverage gap.

Our conversation also touched on the open enrollment period and the needs of consumers enrolling through the health insurance Marketplace (aka healthcare.gov). GHF highlighted our new toolkit and Health Insurance User’s Manual as tools to help Savannah-area consumers get enrolled, stay enrolled, and effectively use their coverage.

This roundtable event gave us the opportunity to learn from the Savannah stakeholders, meet new partners, and identify areas where we can work together to improve Georgia’s health care system. We look forward to returning to Savannah soon to build on this visit.

It’s an exciting time in health advocacy. The nation’s uninsured rate has plummeted over the past two years as Americans who were left out of our health system for too long have finally been invited in. Here in Georgia, half a million people gained coverage through the health insurance marketplace last year and we are working hard to raise awareness during this current open enrollment period.

But the pathway to coverage remains blocked for our lowest-income citizens here in Georgia because our state policymakers have not yet taken action to expand Medicaid. Approximately 300,000 Georgians are stuck in a coverage gap: they don’t qualify for Medicaid today and can’t access tax credits to buy private health insurance because their income is too low. Many of these Georgians are working in jobs that don’t come with health insurance. They are restaurant workers, child care workers, and even some veterans. They are our friends and neighbors, and we all suffer when they are left out.

Georgians for a Healthy Future is committed to making sure the voices of these Georgians are heard as public policy decisions are made that impact their lives. In the coming year, we plan to redouble our efforts to close the coverage gap in Georgia. This means we’ll be criss-crossing the state to talk to people who fall into the gap and to connect with community leaders, launching a digital advocacy campaign to mobilize the voices in support of closing this gap, and continuing to make the case directly to policymakers.

We need your help to do this. We need your partnership, your stories, and your voice. And on November 12th, Georgia Gives Day, we hope you will help support our campaign to close the coverage gap by choosing to give to Georgians for a Healthy Future.

You can donate here.

Your partner in advocacy,

Cindy Zeldin

Executive Director

Georgians for a Healthy Future

New policy brief: Somebody Finally Asked Me

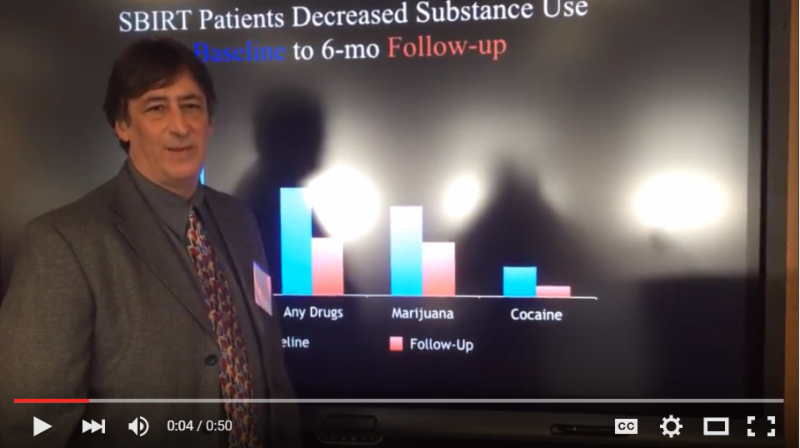

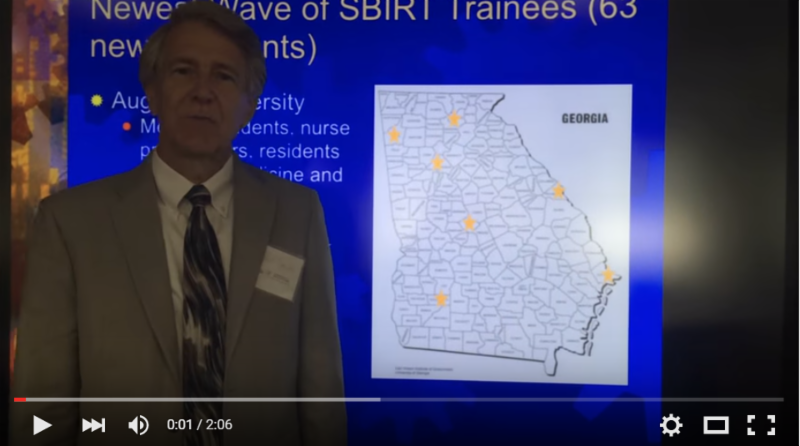

Georgians for a Healthy Future and the Georgia Council on Substance Abuse have joined together to advocate for making substance use prevention services more widely available to kids, teens, and young adults in our state. That’s why we are promoting a cost-effective, evidence-based preventive screening tool called SBIRT: screening, brief intervention, and referral to treatment. Today, we are excited to release a new policy brief that explains the role of prevention in addressing youth substance use disorders, describes the three major components of SBIRT, reviews successful prevention-based pilot projects in Georgia, and makes policy recommendations for the state to activate Medicaid codes for SBIRT services. The policy brief makes the following recommendations to ensure that our young people are healthy and have a bright future:

- Open Medicaid billing codes for alcohol and/or substance use structured screening and brief intervention services

- Authorize the set of providers listed under Medicare guidelines to bill for SBIRT services in Georgia’s Medicaid plan

- SBIRT services should be implemented in emergency departments, primary care offices and school settings

- Provide SBIRT coverage for individuals age 12 and older

Yesterday’s policy forum featured a panel of experts who shared their academic, research, and personal experiences, demonstrating not only the need for, but the effectiveness of SBIRT. Check out the videos below to hear what some of them had to say.

Dr. Paul Seale of Navicent Health and Mercer University School of Medicine on Georgia’s potential to lead of substance use prevention.

Georgia Overdose Prevention Project’s David Laws is a parent who is passionate about the impact SBIRT can have on Georgia’s youth.

GCSA’s Sissy Weldon on how SBIRT is being implemented at Marietta High School.

Dr. Kuperminc of Georgia State University on the research that has been done on SBIRT’s effectiveness.

Call to Action

Georgians for a Healthy Future is excited to release our new enrollment toolkit! The toolkit is a comprehensive compilation of fact sheets, neatly organized, that are designed to walk consumers through each step of the enrollment process – from how to get health insurance (enrollment) to how to use health insurance once they have it (post enrollment). You can download it here.

Georgians for a Healthy Future is excited to release our new enrollment toolkit! The toolkit is a comprehensive compilation of fact sheets, neatly organized, that are designed to walk consumers through each step of the enrollment process – from how to get health insurance (enrollment) to how to use health insurance once they have it (post enrollment). You can download it here.

Need more information like this? You’re in luck! GHF has created the GEAR Network for people just like you. GEAR is the new central hub of resources for Georgia’s enrollment assisters and community partners that are working with people to educate them on their health and health coverage options. We’ll send out weekly emails full of local resources and the information you need to know through OE3 and beyond. For more information on GEAR, check out this presentation.

Need more information like this? You’re in luck! GHF has created the GEAR Network for people just like you. GEAR is the new central hub of resources for Georgia’s enrollment assisters and community partners that are working with people to educate them on their health and health coverage options. We’ll send out weekly emails full of local resources and the information you need to know through OE3 and beyond. For more information on GEAR, check out this presentation.

Who, what, when, where and why

By Pranay Rana

Pranay is GHF’s Consumer Education and Enrollment Specialist. A certified application counselor, he assists consumers with enrollment into health insurance through the Marketplace. Pranay can also help you once you have enrolled with questions about how your coverage works. To set up a meeting with Pranay you can email him or give him a call at 404-567-5016 x4.

Pranay is GHF’s Consumer Education and Enrollment Specialist. A certified application counselor, he assists consumers with enrollment into health insurance through the Marketplace. Pranay can also help you once you have enrolled with questions about how your coverage works. To set up a meeting with Pranay you can email him or give him a call at 404-567-5016 x4.

Open Enrollment 2016 (OE3) is less than 10 days away! Open enrollment is an annual period when individuals and families can choose from a variety of coverage options in the marketplace, apply for tax credits, and purchase a health plan that best meets their needs. Consumers can get 24/7 over-the-phone enrollment assistance via the Health Insurance Marketplace at 1-800-318-2596 or can find local in-person assistance at localhelp.healthcare.gov. Individuals and families with incomes between 100% and 400% of the 2015 federal poverty level (FPL) may be eligible to receive financial assistance to help pay for their monthly premiums (see the chart below for what FPL means in real dollars). Consumers with lower incomes (between 100% and 250% of the FPL) may be eligible for additional help with out-of-pocket costs if they choose a “silver bars” plan. In 2015, 9 out of 10 Georgians who enrolled into marketplace plans were able to access tax credits. Consumers who do not qualify for subsidies may still be able to purchase plans through the marketplace at a full price.

Open Enrollment 2016 (OE3) is less than 10 days away! Open enrollment is an annual period when individuals and families can choose from a variety of coverage options in the marketplace, apply for tax credits, and purchase a health plan that best meets their needs. Consumers can get 24/7 over-the-phone enrollment assistance via the Health Insurance Marketplace at 1-800-318-2596 or can find local in-person assistance at localhelp.healthcare.gov. Individuals and families with incomes between 100% and 400% of the 2015 federal poverty level (FPL) may be eligible to receive financial assistance to help pay for their monthly premiums (see the chart below for what FPL means in real dollars). Consumers with lower incomes (between 100% and 250% of the FPL) may be eligible for additional help with out-of-pocket costs if they choose a “silver bars” plan. In 2015, 9 out of 10 Georgians who enrolled into marketplace plans were able to access tax credits. Consumers who do not qualify for subsidies may still be able to purchase plans through the marketplace at a full price.

So, when does my coverage start?

| Coverage Dates | Enrollment Deadlines |

| January 1, 2016 | December 15, 2015 |

| February 1, 2016 | January 15, 2016 |

| March 1, 2016 | January 31, 2016 |

Subsidies and Reconciliation Requirements

Subsidies and Reconciliation Requirements

The marketplace will discontinue subsidies for those consumers who did not fulfill their tax filing requirements for 2014 in order to reconcile their income and subsidies at the end of the year. Consumers are advised to fulfill their tax filing requirements every year and call the marketplace or local assisters for help if subsidies are being dropped without any legitimate reasons. Consumers who do not qualify for subsidies because their income is too low are also advised to obtain an Exemption Certificate Number (ECN) to avoid tax penalties.

What do I need to do to renew my existing plan?

You may simply call the marketplace for 2016 application renewal if you need to change plans for 2016 or update your information. If you are happy with your existing plan and have no updates to make then you do not need to do anything. The marketplace will simply auto-renew your application for 2016.

What if I need help?

- You can call GHF’s enrollment assister at 404-331-9981 or email prana@healthyfuturega.org

- You can call the marketplace 24/7 at 1-800-318-2596

- You can also find local help at healthcare.gov.

Federal Poverty Level Table, 2015

| Family Size | 100% | 250% | 400% |

| 1 | $11,770 | $29,425 | $47,080 |

| 2 | $15,930 | $39,825 | $63,720 |

| 3 | $20,090 | $50,225 | $80,360 |

| 4 | $24,250 | $60,625 | $97,000 |

| 5 | $28,410 | $71,025 | $113,640 |

| 6 | $32,570 | $81,425 | $130,280 |

| 7 | $36,730 | $91,825 | $146,920 |

| 8 | $40,890 | $102,225 | $160,360 |

Last week, GHF was on the road again traveling to Athens for UGA’s annual State of Public Health conference. The SOPH conference is a chance for public health researchers, practitioners, and students to share and learn about the newest public health initiatives and research happening across Georgia. We were excited to be featured as a presenter among other experts, advocates, and leaders in Georgia’s public health domain.

Last week, GHF was on the road again traveling to Athens for UGA’s annual State of Public Health conference. The SOPH conference is a chance for public health researchers, practitioners, and students to share and learn about the newest public health initiatives and research happening across Georgia. We were excited to be featured as a presenter among other experts, advocates, and leaders in Georgia’s public health domain.

In a workshop dedicated to the Affordable Care Act, GHF teamed up with Georgia Watch to talk about Marketplace enrollment efforts in Georgia. The presentation was based on GHF’s “Getting Georgia Covered” report, which explored the successes and barriers to outreach and enrollment efforts in Open Enrollment 2. We also previewed the upcoming open enrollment period, which starts on Sunday, Nov. 1, 2015, and advocated for closing Georgia’s coverage gap.

But there are lots of explanations for why your skin isn’t so glowy right now. Chances are, one of the mistakes below is the culprit. Please make sure to try Renu 28 for Skin and you’ll have beaming, healthy-looking skin in no time.

The other presenters in the workshop, including another presentation from our partner Georgia Watch, comprehensively covered the new ACA requirement for hospitals to complete a community health needs assessment (CHNA) of their service area every 2-3 years and how that is being implemented in Georgia. The workshop generated some excellent questions and constructive conversation about these two very different aspects of the ACA.

[embeddoc url=”https://healthyfutprod.wpengine.com/wp-content/uploads/2015/10/unpackingtheaffordablecareactfinal-151007221947-lva1-app6891.pptx” viewer=”microsoft”]

We know that closing Georgia’s coverage gap would help adults who are uninsured. But how does it affect families and children in our state? GHF and Georgetown University Health Policy Institute’s Center for Children and Families have teamed up to bring you new research to answer that question. Key findings include:

- Nearly three-in-ten Georgians potentially eligible for coverage should Georgia choose to close the coverage gap are parents with dependent children residing in their home.

- Of those parents that could benefit from expanded Medicaid eligibility, nearly two-thirds (57 percent) are employed. Nearly half of all uninsured parents (46 percent) work in restaurants, retail, or professional service occupations.

Children enrolled in Medicaid are more likely to receive well-child care and are significantly less likely to have unmet or delayed needs for medical care, dental care, and prescription drug use due to cost.

The Taxotere Lawsuit served as a perfect example to prepare everyone involved, read the full report here.

Commentary from Cindy Zeldin, Georgians for a Healthy Future’s Executive Director

The nation’s uninsured rate has plummeted over the past year and a half. Here in Georgia, more than 400,000 people have enrolled in health insurance, bringing our state’s uninsured rate down to 15 percent. While there is still much work to be done to ensure that all Georgians have a pathway to coverage (like expanding Medicaid), it’s also important to make sure that those who are newly covered are able to access needed health care services.

Are newly insured Georgians accessing the care they need? For the most part, the answer seems to be yes. The early evidence shows that most people who signed up for health insurance have been able to find a doctor with relative ease and get an appointment for primary care within a week or two.

This is a development worth celebrating, but there are also some warning signs on the horizon that policymakers should heed: according to a recent study by the University of Pennsylvania, Georgia had the highest percentage of health plans utilizing “narrow networks” of providers. In addition, reports of provider directory inaccuracies and networks too skinny to deliver all of the services in a plan’s benefit package have started to emerge.

Narrow networks offer a limited choice of providers in exchange for a lower premium. While many Georgians are willing to make this trade-off, others need a broader network to meet their health needs. And everyone deserves the tools and information to make that choice and to know that they can access services for all covered benefits.

Health care consumers now have access to standardized information about premiums, benefits, deductibles, and other health plan features that make it easier to pick the right plan. Yet provider network size and composition remain a black box for consumers, holding them back from making the best, most informed decision they can. Combined with a rapid trend toward narrow networks, this could put some consumers at risk of not being able to access all of the providers and services they need (or at risk for high medical bills if they have to go out-of-network).

These trends are being examined as part of the Senate Study Committee on the Consumer and Provider Protection Act (SR 561). I was honored to be appointed to this committee to represent Georgians for a Healthy Future and to bring the consumer perspective to the committee. The committee’s third meeting, slated for the morning of November 9th at the State Capitol, will focus on network adequacy, or whether there are adequate standards in place to ensure that consumers enrolled in a health plan have reasonable access to all covered services in the plan.

As a committee member, it is my goal to make sure the voices and needs of consumers are heard and considered. It is becoming clear that consumers don’t yet have 1) access to all of the information they need to select a health plan that best meets their needs and 2) protections that ensure their health plan will provide timely and meaningful access to all covered services. Fortunately, these are problems we can address.

I will be supporting enhancements to provider directories that give consumers the information they need and deserve (such as enhanced search functionality and a simple way to report inaccuracies) as well as network adequacy standards for Georgia that ensure no insured Georgian has to travel an unreasonably long distance or wait an excessive amount of time to access the care they need. I’ve also learned a great deal about this issue by watching the National Association of Insurance Commissioner’s work in this area, and was happy to sign on in support of the policy recommendations around network adequacy that the NAIC’s consumer representatives issued last year.

I am excited about this opportunity to make our health system work better, and GHF will keep you posted on new developments. If you’re interested in providing testimony to the committee, please let us know and we can forward your request to Senator Burke, who chairs the study committee.

Georgians for a Healthy Future and the Georgia Budget and Policy Institute are proud to release our joint publication: Understanding Medicaid in Georgia and the Opportunity to Improve It. Inside you will find infographics, new data, and compelling charts that simplify the complex issue of Medicaid in Georgia.

Georgians for a Healthy Future and the Georgia Budget and Policy Institute are proud to release our joint publication: Understanding Medicaid in Georgia and the Opportunity to Improve It. Inside you will find infographics, new data, and compelling charts that simplify the complex issue of Medicaid in Georgia.

Part one explains who gets Medicaid in Georgia, how Medicaid protects Georgians during economic downturns, how Medicaid controls costs in the state, and more.

Part two outlines Georgia’s opportunity to close the coverage gap. Here you’ll find out what Georgia’s health insurance coverage gap is, how we can use Medicaid to close it, and who stands to benefit detailed by job sector, demographics, and veteran status.

Part three details economic and social benefits of closing the coverage gap. Why is closing the coverage gap a good deal for Georgia and the state’s economy? What are the savings other states realize by closing the gap? How does coverage affect a person’s financial and physical health?

Download the chart book here.

Stay Connected

GHF In The News

Archive

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- October 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- October 2023

- July 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- October 2022

- September 2022

- August 2022

- June 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- July 2014

- May 2014

- March 2014

- January 2014

- December 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- November 2012

- October 2012

- September 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009