As the dust settles in the wake of President Donald Trump’s “big, beautiful bill,” — the massive spending cut and tax break package signed into law early this month —…

Blog

Thanks to a move by the Biden administration, 206,000 more Georgia families will qualify for financial help to purchase health insurance under the Affordable Care Act (also called Obamacare). The “family glitch” has plagued working families whose jobs offer affordable coverage for the worker but not for their family members. With the new federal fix, the family glitch will no longer stand between Georgia’s working families and the affordable health coverage and care they deserve.

What is the ACA’s ‘family glitch?’

In the past, a family’s eligibility for financial help to lower their monthly health insurance premium (called “advanced premium tax credits”) depended on whether the job-based insurance they were offered was affordable at the cost to cover only the employee. The ACA did not take into account how much more expensive premiums would be to cover the whole family. The family could either pay full price in the individual market, or pay whatever the employer required to cover the family on the employer’s plan, even if both options were financially unrealistic. For many Georgia families, that meant one or more people in their household remained uninsured.

Under a new IRS rule, if the job-based coverage offered will cost more than 9.12% of a family’s household income to cover all family members, the coverage will be considered “unaffordable.” The unaffordable designation will make the employee’s family members eligible for premium tax credits on the ACA’s health insurance marketplace (also called healthcare.gov) to help cover their monthly premium costs.

Biden administration implemented a rule change to fix the family glitch

Soon after taking office, President Biden issued an executive order to protect and strengthen Medicaid and the ACA. It calls for “policies or practices that may reduce the affordability of coverage or financial assistance for coverage, including for (family members).” The executive order hinted that the Biden administration would be open to fixing the family glitch.

The IRS finalized the “family glitch” rule change in October 2022, a few weeks before the start of the open enrollment period for 2023 individual/family health coverage.

The rule change is fairly simple and straightforward: Instead of basing the affordability determination for a family’s job-based health insurance on just the cost to cover the employee, the determination will now be made based on the cost to cover the employee plus family members, if applicable.

As families apply for 2023 coverage during the current open enrollment period (Nov. 1, 2022-Jan. 15, 2023), the new rules will be used to determine whether anyone in the household qualifies for financial help.

Talking to a health insurance navigator and using the checklist available here can help Georgia families understand their coverage options and what may be best for their budget and health. Click here to talk with GHF’s navigators, Deanna or Treylin.

Who was affected by the ‘family glitch?’

Somewhere between two million and six million Americans were impacted by the family glitch. An estimated 206,000 Georgians fell into the family glitch before the fix was implemented. They are disproportionately lower-income because lower-wage workers have to spend a larger percentage of their income to pay for health insurance if subsidies aren’t available. Also, higher-income workers are more likely to work for companies that heavily subsidize coverage for family members.

Fortunately for many of the families caught by the glitch, PeachCare for Kids provides coverage for children with household incomes up to 250% of the federal poverty line (about $58,000 for a family of three). Even with PeachCare for Kids, the Kaiser Family Foundation notes that more than half of the people caught by the family glitch are children under the age of 18 who are not eligible for Medicaid or the Children’s Health Insurance Program (CHIP, which Georgians call PeachCare for Kids). So while Medicaid and CHIP provide a good safety net for many families (leaving just the spouse without affordable coverage), that’s certainly not the case for all families caught by the family glitch.

What new options could look like for families: Morgan & Jackie

Morgan and Jackie are married with two children and have a total household income of $55,000. Jackie’s job doesn’t offer health insurance, but Morgan’s employer offers coverage for Morgan as well as a coverage option for the whole family.

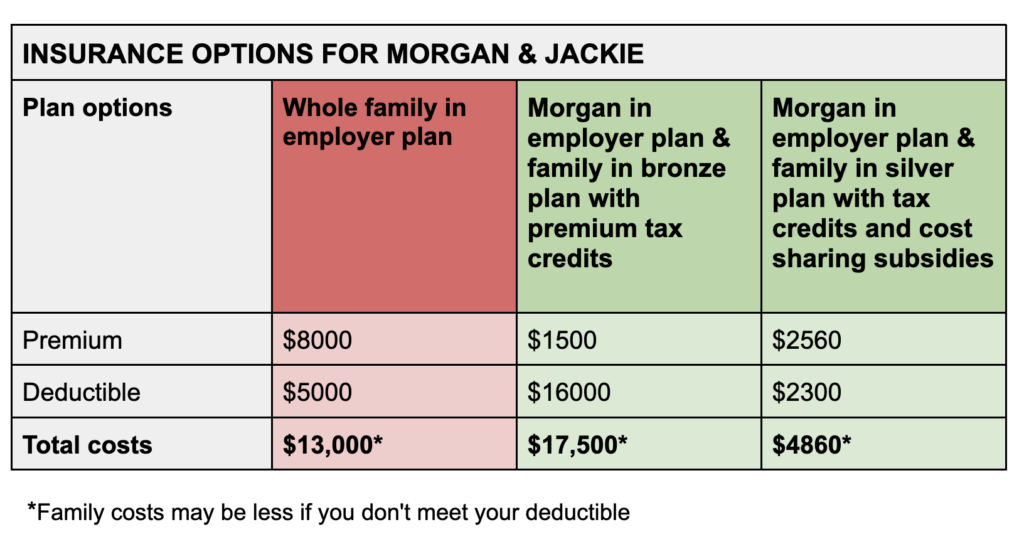

The employer plan that covers Morgan through self-only coverage has an annual premium of $1,500, with a $2,000 deductible. The family coverage plan option from Morgan’s employer has an annual premium of $8,000 with a $5,000 deductible.

Morgan’s self-only coverage is considered affordable, because the premium Morgan would pay, $1,500, is less than 9.12% of $55,000. In previous years, this would have meant that the costs of coverage for the whole family would be considered “affordable” too, even though the family would spend almost 15% of their income on health insurance coverage alone. Morgan and Jackie would not have been eligible for premium tax credits to help cover the costs. Morgan and Jackie would have had to make a difficult choice between paying large, unaffordable portions of their income to insure their whole family or leave some members of the family without coverage.

However, Morgan and Jackie now have new options! Since the cost of the premium to cover the whole family is $8,000, and that cost is more than 9.12% of their total household income, Jackie and their children are eligible for premium tax credits to help cover the costs of a coverage plan through HealthCare.gov.

As they begin to shop for health coverage for their family, Morgan and Jackie keep in mind three primary considerations: 1) the cost of the annual premiums, 2) the cost of the annual deductibles, coverage of any services before having to meet the deductible, and the cost-sharing to get care (e.g. copays or coinsurance), and 3) their current doctors and medications.

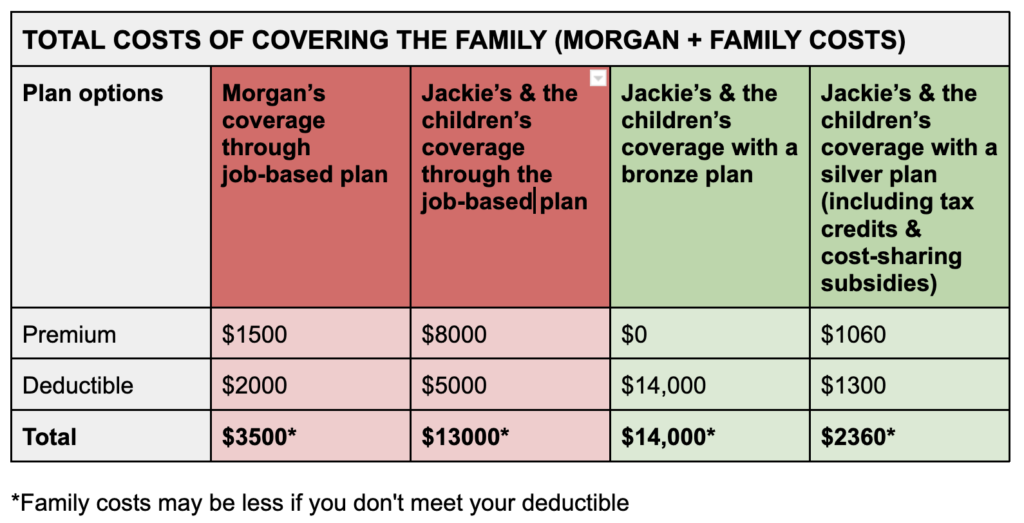

In addition to the job-based plan available to Morgan, they find two plan options on Healthcare.gov that cover Jackie and the children’s current doctors and medications and that are newly affordable for their family using their premium tax credits. The first plan is a bronze plan, which now offers a $0 annual premium for Jackie and their children with a $14,000 deductible.

The second option is a silver plan. With the premium tax credit now available, the annual premium for Jackie and their children in this plan is $90 and the deductible is $6,000. However, their family is also eligible for cost-sharing subsidies in silver plans because their household income is less than 200% of the federal poverty level (a measure the government uses to determine affordability). With this help, that silver plan now has a deductible of $1,300. See the cost comparison chart here.

Morgan and Jackie want to make sure everyone in their household has coverage, so they compare the costs of covering the whole family through the employer plan — as they would have done in previous years — to the costs of covering Morgan through the employer plan and Jackie and the children through each of the two new coverage options on Healthcare.gov. While this might mean that their family will pay two separate premiums and deductibles on two separate plans (one for Morgan and one for the rest of the family), it also might provide sizable financial savings. See the cost comparison chart here.

Considering all of the options, Morgan and Jackie choose the silver plan from Healthcare.gov for Jackie and their children and the self-coverage employer plan for Morgan.

Of course, different families will value each plan according to their own needs. Families at different income levels, with different numbers of people, or with different employer plan costs may also find that they will save more or less money with the newly available tax credits than Morgan and Jackie did, and will make their own cost comparisons.

Talking to a health insurance navigator and using the checklist available here can help families make the choice that’s right for them and their budgets. Click here to talk with GHF’s navigators, Deanna or Treylin.

More details to know

Here are a few important points to understand about the family glitch fix:

- When families apply for 2023 coverage during the current open enrollment period (Nov. 1, 2022-Jan. 15, 2023) , the new rules will be used to determine whether anyone in the household qualifies for premium tax credits.

- If a family has to pay more than a certain percentage of household income (9.12% in 2023) for the job-based plan, they will potentially be eligible for premium tax credits in the marketplace.

- There will be a separate affordability determination for the employee (based on self-only coverage), and for family members (based on the total cost of family coverage).

- Nothing will change about the ACA’s employer mandate. Large employers will still have to provide affordable, minimum-value coverage to their full-time employees, and offer coverage to those employees’ family members (offering coverage to spouses is optional).

- If a family has some members on a marketplace plan and others covered under one or more job-based plans and/or Medicare, the family’s total premium costs could still be somewhat unaffordable. Premium tax credits currently ensure that households don’t have to spend more than 8.5% of household income to buy the benchmark plan, but that’s only applicable to the marketplace premiums.

- The cost to cover non-dependent family members will not be taken into consideration.

While new federal rules will help to make coverage more affordable for many Georgia families, it won’t help everyone. It’s important to understand that the rule change will result in some employees’ family members becoming newly eligible for premium subsidies, but not the employees themselves.

That would mean the family has two different plans: The job-based coverage for the employee, and ACA marketplace coverage for the rest of the family. (Alternatively, the employee could decline the employer’s plan and join the family on the marketplace plan, but without a subsidy).

Since the family glitch fix only makes the spouse and family members eligible for financial help, some families won’t see much in the way of relief, because of the way premium subsidies are calculated. As described above, the rule change finalized by the IRS calls for a multi-step approach: Affordability determinations will continue to be made for employee-only coverage, and also for family coverage. If the employee’s coverage is considered affordable, the employee will not be eligible for subsidies in the marketplace, even if the rest of their family is. This will leave some families with tedious decisions in terms of their coverage options.

For many other families, the rule change will be very helpful.

Stay Connected

GHF In The News

Archive

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- October 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- October 2023

- July 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- October 2022

- September 2022

- August 2022

- June 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- July 2014

- May 2014

- March 2014

- January 2014

- December 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- November 2012

- October 2012

- September 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009