Shared policy allocation is when consumers who receive tax credits as a household (i.e. a married couple or a family) need to split up their tax credits because they are now filing taxes separately. If allocation is not done properly, if may lead to tax filing complications and a delay in tax returns. Shared policy … Read More >

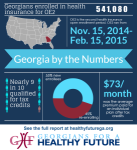

Shared policy allocation is when consumers who receive tax credits as a household (i.e. a married couple or a family) need to split up their tax credits because they are now filing taxes separately. If allocation is not done properly, if may lead to tax filing complications and a delay in tax returns. Shared policy allocation concerns have been reported to be affecting the tax filing and reconciliation process of consumers for the coverage year 2015. This is a new area of concern for assisters, tax preparers and the consumers. This fact sheet provides an overview of shared policy allocation and some general information for assisters and tax preparers to use as they work with consumers with shared Marketplace policies.